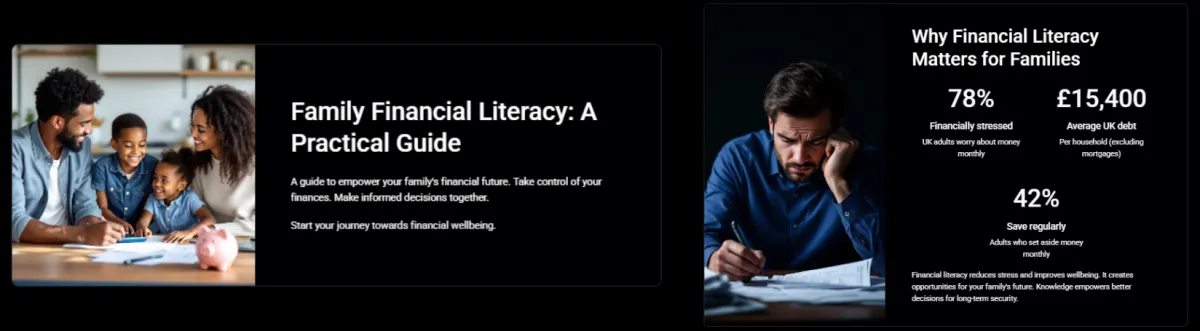

To get you started please download our Family Financial Independence free guide. Take your first step toward financial freedom with our starter guide. Download it now to begin your journey to secure your family's financial future.

Our Mission & Vision

At Mastering Money Matters, John and I are on a mission to create awareness around essential financial concepts/principles that most of us were never taught in school or by our parents. We believe this knowledge gap is the primary reason for the growing financial divide in our society, and we're committed to bridging that gap for everyday families.

Our founding philosophy is simple yet powerful: It's not about how much money you make, but how much you keep and then multiply. This perspective shift has transformed our own financial journeys and those of the families we've worked with.

Our Philosophy

We're massive advocates for children's financial education while also recognizing that parents need these tools too. After all, most of us weren't taught these lessons.

We've learned along the way that not all advice is good advice. Had I followed what a 'specialist' advised, it would have added around 13 years to my mortgage. Because the information didn't resonate, I asked the right questions and made an educated decision that saved me a huge amount of money and time. We encourage the same healthy scepticism, even with the information we provide. We're not specialists and don't claim to know everything. However, we're also not working for profits from financial products, and we do have your best interests in mind. Please always do your own research and do what aligns with your and your family's values and goals.

The Spark

Our company was born from personal experience and inspired by a story of a 10 year old child who was asked what they would do with a £1, and the answer was remarkable (a story that will be happily shared during the webinar). So much so that it caused one of our founders to question everything he thought he knew about money.

The Realization

This moment crystallized our purpose: financial education must reach both parents and children to create lasting change. Children generally come up with genius ideas and we as adults need to start paying attention. Were you shut down as a child and told "don't be silly" or "you can't…"? It is us the adults that can't, not them, and we need to encourage children and, if anything, get them to dream bigger. Remember they are (and will shape) the future.

Proven Results

What sets us apart is our commitment to practical, implementable strategies rather than theoretical concepts. We've used these same techniques to help real families create dramatic improvements, including one client who reduced their monthly expenses by £800 without sacrificing their quality of life.

Our Method

We share our authentic personal stories including early ventures into property investment, mistakes made, and lessons learned because we believe in the power of relatable experiences. Our founder challenged conventional financial advice, discovered what works for him, and now brings these insights to families ready for transformation.

Core Foundations & Philosophy

• Simplify Complex Topics

We simplify complex topics like credit cards, taxes, and mortgage types into understandable, actionable information

• Investment Education

We highlight the transformative potential of investing and compound interest through everyday examples that make these concepts accessible

• Debt Elimination Techniques

We provide techniques to understand your true outgoings and systematically eliminate debt

• Mindset Transformation

We guide you through the mindset shifts necessary for financial success, helping you develop new perspectives on money

Don't miss out! Join the waitlist today to secure early access to the next course

For more information and for course details please use the contact us button below

Copyright - All Rights Reserved